What Credit Score Do I Need to Take Out a Personal Loan?

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

When you apply for a personal loan, your credit score will play a large role in determining whether you get approved. In most cases, you’ll need good to excellent credit — a good credit score is usually considered to be 700 or higher.

You’ll typically need good credit to get approved as well as to qualify for the most optimal interest rates. There are also several lenders that offer personal loans for bad credit, but these loans usually come with higher interest rates compared to good credit loans.

If you’re wondering what credit score you need for a personal loan, here’s what you should know:

When you apply for a personal loan, your selected lender will check your credit score

A credit score is a risk score that’s calculated using information gathered by the three credit bureaus: Experian, Equifax, and TransUnion. When you apply for a personal loan, the lender will review your credit to determine how likely you are to repay the loan.

Generally, borrowers with high credit scores are seen as less of a risk than borrowers with bad credit — which is why good credit borrowers typically have an easier time getting approved. There are also several lenders that offer personal loans for bad credit, but keep in mind that these loans usually come with higher interest rates compared to good credit loans.

If you find any errors, dispute them with the appropriate credit bureau to potentially boost your credit score.

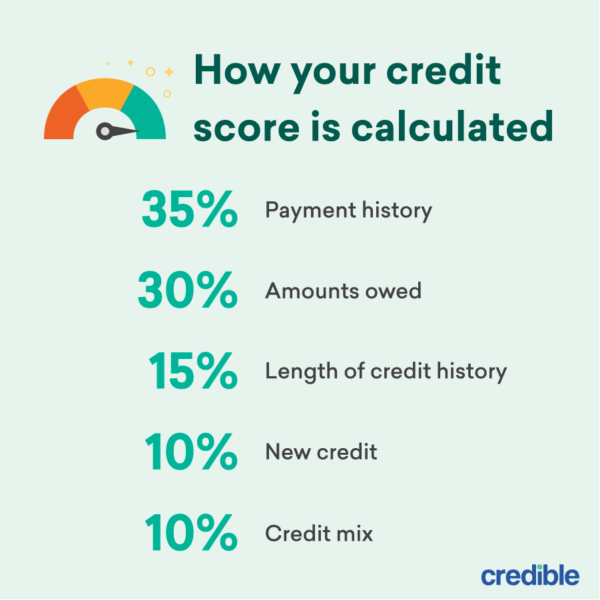

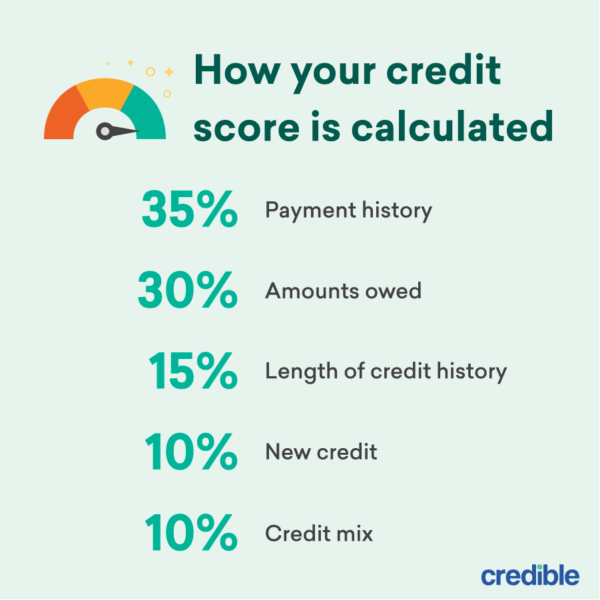

What factors affect your credit score?

There are five main factors that make up your credit score, including:

- Payment history: Lenders want to see that you have a history of making on-time payments. Your payment history makes up the largest portion of your credit score.

- Amounts owed: Your credit utilization is the amount you owe on revolving credit lines compared to your overall credit limits. Keeping your credit utilization as low as possible can help show lenders that you aren’t overextending yourself financially.

- Length of credit history: Having a long credit history shows you’re experienced and able to handle credit. This is why it’s usually a good idea to keep accounts open even if you’re not using them.

- New credit: Whenever you apply for a new credit account — such as a loan or credit card — it can temporarily impact your credit. Opening multiple accounts in a short period of time can make you seem like more of a risk to lenders.

- Credit mix: Having a diverse portfolio of credit accounts — including both installment loans as well as revolving credit — is another way to show lenders that you can reasonably manage multiple kinds of debt.

- Verifiable income that supports your ability to repay the loan

- Low debt-to-income ratio — usually no higher than 40%

Learn More: How to Get a Personal Loan

How a personal loan will affect your credit

Many lenders allow borrowers to see their personalized loan offers with only a soft credit check that won’t affect their credit — for example, you can compare your prequalified rates from Credible’s partner lenders with no impact on your credit.

However, when you actually apply for a personal loan, the lender will perform a hard credit check to determine your creditworthiness. This could cause a slight drop in your credit score — though this is usually only temporary, and your score will likely bounce back within a few months.

Ultimately, these positive effects could far outweigh any initially negative impact.

What credit score do you need to take out a personal loan?

Personal loan requirements — including the credit score you’ll need to qualify — vary by lender. Generally, you’ll need good to excellent credit, which typically means having a score of 700 or higher.

Keep in mind that having a good credit score can also help you qualify for the most optimal interest rates. For example, here are the average personal loan interest rates offered to borrowers who took out a three-year loan through Credible in December 2021 based on their credit scores:

| Credit score ranges | Average APR |

| Less than 600 | 32.06% |

| 600 to 639 | 29.64% |

| 640 to 679 | 24.70% |

| 680 to 719 | 17.97% |

| 720 to 779 | 12.50% |

| 780 or above | 8.92% |

What if you have a poor credit score?

There are also several lenders that offer personal loans for bad credit. This means you could still have a chance of approval even if your credit is less than stellar — though remember that these loans usually come with higher interest rates compared to good credit loans.

A cosigner can be anyone with good credit — such as a parent, another relative, or a trusted friend — who is willing to share responsibility for the loan. Just keep in mind that this means they’ll be on the hook if you can’t make your payments.

Before applying for a personal loan, be sure to shop around and consider your options from as many lenders as possible. This way, you can find the right loan for your needs.

This is easy with Credible. Below you’ll find our partner lenders that offer personal loans for bad credit — you can compare your prequalified rates from each of them in just two minutes.

| Lender | Fixed rates | Loan amounts | Min. credit score | Loan terms (years) |

|---|---|---|---|---|

|

9.95% – 35.99% APR | $2,000 to $35,000** | 550 | 2, 3, 4, 5* |

|

||||

|

4.99% – 35.99% APR | $5,000 to $35,000 | 600 | 2, 3, 4, 5 |

|

||||

|

5.99% – 24.99% APR | $2,500 to $35,000 | 660 | 3, 4, 5, 6, 7 |

|

||||

|

7.04% – 35.89% APR | $1,000 to $40,000 | 600 | 3, 5 |

|

||||

|

9.99% – 35.99% APR | $2,000 to $36,500 | 580 | 2, 3, 4 |

|

||||

|

2.49% – 19.99% APR | $5,000 to $100,000 | 660 | 2, 3, 4, 5, 6, 7 (up to 12 years for home improvement loans) |

|

||||

| 6.99% – 19.99% APR1 | $3,500 to $40,0002 | 660 (TransUnion FICO®️ Score 9) |

3, 4, 5, 6, 7 | |

|

||||

|

18.0% – 35.99% APR | $1,500 to $20,000 | None | 2, 3, 4, 5 |

|

||||

|

5.99% – 24.99% APR | $5,000 to $40,000 | 600 | 2, 3, 4, 5 |

|

||||

|

4.99% – 17.99% APR | $600 to $50,000 (depending on loan term) |

660 | 1, 2, 3, 4, 5 |

|

||||

|

6.95% – 35.99% APR | $2,000 to $40,000 | 640 | 3, 5 |

|

||||

|

8.93% – 35.93% APR7 | $1,000 to $50,000 | 560 | 3, 5 |

|

||||

|

5.94% – 35.97% APR | $1,000 to $50,000 | 560 | 2, 3, 5, 6 |

|

||||

|

4.37% – 35.99% APR4 | $1,000 to $50,0005 | 580 | 3 to 5 years4 |

|

||||

| Compare rates from these lenders without affecting your credit score. 100% free!Compare Now |

||||

| All APRs reflect autopay and loyalty discounts where available | LightStream disclosure | 10SoFi Disclosures | Read more about Rates and Terms | ||||

What loan features should you consider before choosing a lender?

As you weigh your personal loan options, it’s important to take your time to compare as many lenders as you can. This way, you can find a loan that best suits your needs.

Here are several important factors to keep in mind while doing your research:

- Interest rate: Your loan interest rate will play a major role in determining your overall loan cost — in general, the lower your interest rate, the less you’ll pay on your loan over time. Keep in mind that other factors such as your credit and the repayment term you choose will affect the rates you’re offered.

- Repayment terms: You’ll generally have one to seven years to repay a personal loan, depending on the lender. It’s usually best to choose the shortest term you can afford to keep your interest costs as low as possible. Many lenders also offer better rates to borrowers who opt for shorter terms.

- Loan amounts: With a personal loan, you can typically borrow $600 up to $100,000 or more, depending on the lender. Be sure to borrow only what you need so your future repayment costs are manageable.

- Fees: Some lenders charge fees on personal loans, such as origination fees or late fees. These can increase your overall loan cost. Keep in mind that if you take out a loan with one of Credible’s partner lenders, you won’t have to worry about prepayment penalties.

- Cosigner option: If you have poor credit, applying with a cosigner could help you get approved for a personal loan — this might also get you a better interest rate. Not all lenders allow cosigners on personal loans, though, so you’ll need to check before you apply.

Before you apply for a personal loan, be sure to consider how much the loan will cost you. This way, you can be prepared for any added expenses.

You can estimate how much you’ll pay for a loan using our personal loan calculator below.

Enter your loan information to calculate how much you could pay

With a $ loan, you will pay $ monthly and a total of $ in interest over the life of your loan. You will pay a total of $ over the life of the loan.

Apply for a personal loan

If you’re ready to apply for a personal loan, follow these four steps:

- Compare lenders. Be sure to compare as many lenders as possible to find the right loan for your situation. Consider not only rates but also repayment terms, any fees charged by the lender, and eligibility requirements.

- Pick a loan option. After comparing lenders, choose the loan option that best suits your needs.

- Complete the application. Once you’ve picked a loan option, you’ll need to fill out a full application and submit any required documentation, such as pay stubs or tax returns.

- Get your funds. If you’re approved, the lender will have you sign for the loan so the funds can be released to you. The time to fund for a personal loan is usually about one week — though some lenders will fund loans as soon as the same or next business day after approval.

If you decide to take out a personal loan, remember to consider as many lenders as you can to find the right loan for you. Credible makes this easy — you can compare your prequalified rates from multiple lenders in two minutes.

Ready to find your personal loan?

Credible makes it easy to find the right loan for you.

Find My Rate

Checking rates won’t affect your credit

About Rates and Terms: Rates for personal loans provided by lenders on the Credible platform range between 4.99-35.99% APR with terms from 12 to 84 months. Rates presented include lender discounts for enrolling in autopay and loyalty programs, where applicable. Actual rates may be different from the rates advertised and/or shown and will be based on the lender’s eligibility criteria, which include factors such as credit score, loan amount, loan term, credit usage and history, and vary based on loan purpose. The lowest rates available typically require excellent credit, and for some lenders, may be reserved for specific loan purposes and/or shorter loan terms. The origination fee charged by the lenders on our platform ranges from 0% to 8%. Each lender has their own qualification criteria with respect to their autopay and loyalty discounts (e.g., some lenders require the borrower to elect autopay prior to loan funding in order to qualify for the autopay discount). All rates are determined by the lender and must be agreed upon between the borrower and the borrower’s chosen lender. For a loan of $10,000 with a three year repayment period, an interest rate of 7.99%, a $350 origination fee and an APR of 11.51%, the borrower will receive $9,650 at the time of loan funding and will make 36 monthly payments of $313.32. Assuming all on-time payments, and full performance of all terms and conditions of the loan contract and any discount programs enrolled in included in the APR/interest rate throughout the life of the loan, the borrower will pay a total of $11,279.43. As of March 12, 2019, none of the lenders on our platform require a down payment nor do they charge any prepayment penalties.