The Pros and Cons of Student Loans: Are They Worth It?

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Deciding whether or not to take out student loans to pay for school can be a tough choice. On one hand, loans could be an investment in your future — but on the other, repaying them is a long-term financial commitment that might impact your ability to reach other milestones after leaving school, like buying a house or starting a family.

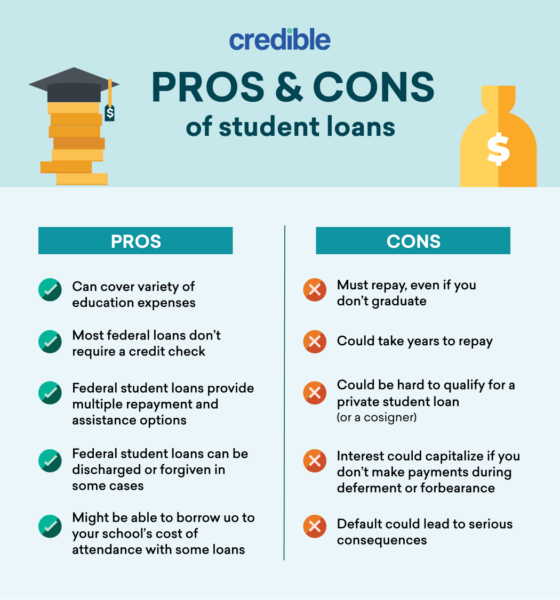

As you weigh your options, here are several important pros and cons of student loans to keep in mind:

Pros and cons of student loans

If you need to pay for college, it’s a good idea to start with the kinds of aid that don’t have to be repaid — such as college scholarships and grants. But if these aren’t enough to cover your costs, you might have to borrow money to make up the difference.

College students have two major types of student loans available to them — federal student loans issued by the government and private student loans offered by private lenders. If you’re thinking about getting a student loan, here are some major pros and cons to consider first:

| Pros | Cons |

|---|---|

|

|

If you decide to take out a private student loan, be sure to consider as many lenders as possible to find the right loan for your needs. Credible makes this easy — you can compare your prequalified rates from multiple lenders in two minutes.

See Your Rates

Checking rates will not affect your credit

Pros and cons of federal student loans

If you need to borrow for school, it’s usually best to start with federal student loans. This is mainly because these loans come with federal benefits and protections — such as access to income-driven repayment plans and student loan forgiveness programs.

Keep in mind that some aid is given on a first-come, first-served basis — so it’s a good idea to submit the FAFSA as early as possible, especially if you have high financial need.

Before you take out a federal student loan, here are some advantages and disadvantages to consider:

Advantages of federal student loans

- Fixed rates: All federal student loans come with fixed interest rates. This means your rate will stay the same throughout the life of the loan, and your payments will change only if you sign up for a different repayment plan.

- Don’t require a credit check: Most federal student loans don’t require a credit check, which can make them a great option if you have poor or no credit.

- Multiple repayment and assistance options: In addition to the standard 10-year repayment plan, federal student loans offer several other repayment plans, such as income-driven repayment (IDR) or graduated repayment plans. Federal student loan borrowers also have access to assistance options if they’re struggling to make their payments — for example, you might be able to temporarily postpone your payments through deferment or forbearance.

- Potential loan forgiveness or discharge: Several student loan forgiveness programs are available. For example, if you work for a government or nonprofit organization and make qualifying payments for 10 years, you could qualify for Public Service Loan Forgiveness. Or if you sign up for an IDR plan, you could have any remaining balance forgiven after 20 or 25 years, depending on the plan. Additionally, federal student loans can be discharged in certain cases, such as if your school closes while you’re enrolled.

- Might be able to borrow up to your school’s cost of attendance: If you take out a Direct PLUS Loan, you might be able to borrow up to your school’s cost of attendance (minus any other financial aid you’ve received). Keep in mind that unlike most other federal student loans, PLUS Loans require a credit check.

Learn More: How to Apply to College and When You Should Apply

Disadvantages of federal student loans

- Must repay your loans even if you didn’t graduate: No matter if you complete your program or not, you’ll be on the hook for repayment.

- Could take years to repay: Federal student loans typically start on the standard 10-year repayment plan. But if you opt for a different repayment plan or consolidate them, you could end up repaying them for up to 25 or 30 years.

- Interest could capitalize when you’re not making payments: Depending on the type of federal loan you have, interest might continue to accrue on the loan during periods of forbearance and deferment. This unpaid interest could then be added to your principal balance — a process known as capitalization.

- Can only change your interest rate through refinancing: The only way that you might be able to reduce your interest rate is by refinancing your federal student loan. However, doing so will cost you access to federal benefits and protections — such as IDR plans and student loan forgiveness programs.

- Defaulting can come with major consequences: Most federal loans enter default if you miss payments for 270 days. Defaulting can result in major consequences — such as your entire balance becoming due immediately, severe damage to your credit, wage garnishment, withholding of your tax returns, and ineligibility for federal benefits like deferment and forbearance.

If you’re considering federal vs. private student loans, here are several important points to keep in mind:

| Federal student loans | Private student loans | |

|---|---|---|

| Interest rates | 3.73% – 6.28%* (depending on loan type) |

Fixed rates from (APR): 2.99%+

Variable rates from (APR): 0.94%+ (Private lenders on Credible) |

| Offers subsidized loans | Yes | No |

| Loan forgiveness | Yes | No |

| Option to change repayment plan or defer payments | Yes | No |

| Requires FAFSA | Yes | No |

| Requires cosigner | Typically no (unless applying for a PLUS loan with adverse credit) |

No (but might increase chances of qualifying) |

| Requires credit check | Only for PLUS loans | Yes |

| *Federal student loan interest rates apply to loans disbursed between July 1, 2021, and July 1, 2022. | ||

Check Out: 5 Steps to Take If You Can’t Afford College

Pros and cons of private student loans

Private lenders — including online lenders as well as traditional banks and credit unions — offer private student loans. Unlike with most federal student loans, you’ll have to undergo a credit check to apply for a private student loan.

Before you take out a private student loan, here are some advantages and disadvantages to consider:

Advantages of private student loans

- Can be used to fill financial gaps: After you’ve exhausted your scholarship, grant, and federal student loan options, private student loans can help fill any financial gaps left over. Like federal loans, private student loans can be used to cover a wide variety of education expenses, such as tuition, textbooks, and room and board.

- No application deadline: Unlike federal student loans that have strict application deadlines, you can apply for a private student loan at any time.

- Lower interest rates: If you have excellent credit or a cosigner with excellent credit, you might qualify for a lower interest rate on a private loan than you’d get on a federal loan.

- Larger loan amounts: With some lenders, you can borrow up to your school’s cost of attendance — more than you can get with federal Direct Subsidized or Unsubsidized Loans.

Learn More: College ROI: 6 Tools to Gauge the Return on Your Degree

Disadvantages of private student loans

- Must repay your loans even if you didn’t graduate: Like with federal loans, you must repay any private student loans that you get — even if you didn’t graduate.

- Could take years to repay: You’ll typically have five to 20 years to repay a private student loan, depending on the lender. While choosing a longer term could get you a lower monthly payment, it’s usually best to pick the shortest term you can afford to save as much as possible on interest charges.

- Fewer options for poor or no credit: You’ll generally need good or excellent credit to qualify for a private student loan — a good credit score is usually considered to be 700 or higher. Some lenders offer student loans for bad credit, but these loans usually come with higher interest rates compared to good credit loans.

- No federal benefits or forgiveness options: Private student loans don’t come with federal protections. Instead, any benefits or assistance options are provided at the discretion of the lender. Additionally, private student loans aren’t eligible for federal forgiveness programs.

- Defaulting can come with major consequences: Most private student loans will enter default after missing payments for 120 days. Like defaulting on a federal loan, defaulting on private loans could lead to major consequences. For example, your loans could be sent to a collections agency, or your lender could sue you in an attempt to recoup their losses. Additionally, you could have your wages garnished if the court allows it.

Even if you don’t need a cosigner to qualify, having one could get you a lower interest rate than you’d get on your own.

If a private student loan seems like the right choice for you, remember to take the time to shop around and compare your options from as many lenders as you can. This way, you’ll have an easier time finding the most optimal loan for your situation.

This is easy with Credible: You can see your prequalified rates from our partner lenders in the table below in two minutes — without affecting your credit.

| Lender | Fixed Rates From (APR) | Variable Rates From (APR) | Loan amounts | Loan terms (years) |

|---|---|---|---|---|

|

3.87%+ | 1.46%+ | $2,001 to $200,000 | 7 to 20 |

|

||||

|

3.48%+1 | N/A | $1,000 to $350,000 (depending on degree) | 5, 10, 15 |

|

||||

|

2.99%+2,3 |

0.94%+2,3 | $1,000 up to 100% of the school-certified cost of attendance | 5, 8, 10, 15 |

|

||||

|

3.2%+ | 1.03%+ | $1,000 to $99,999 annually ($180,000 aggregate limit) |

7, 10, 15 |

|

||||

|

3.02%+7 | 2.51%+7 | $1,000 to $200,000 | 7, 10, 15 |

|

||||

|

3.33%+8 | 1.69%+8 | $1,001 up to 100% of school certified cost of attendance | 5, 10, 15 |

|

||||

|

3.75%+ | N/A | $1,500 up to school’s certified cost of attendance less aid | 15 |

|

||||

|

3.5% – 12.6% APR9 | 1.13% – 11.23% APR9 | Up to 100% of the school-certified cost of attendance | 15 |

|

||||

| Compare private student loan rates without affecting your credit score. 100% free!Compare Private Loans Now |

||||