Assured or assured return program are really good options for Investment decision

Every insurance schemes of all sorts of money back, pension, guaranteed profits work on more or less the same rule. The return is also through 5% to 7%, usually around 6. 25%. Because of this , the question comes “Guaranteed or even assured return plan are actually good options for Investment”.

You will be much better with:

a) in case you purchase a Term Insurance plan of one Crore or more. Also, the premium will be much cheaper.

b) Invest the remaining Portion of the superior in the Mutual fund and get much better returns.

I know when it comes to investing in the particular mutual fund there is a great deal of question arise about specific things like investment safety and security, just how much return it will give, is there any better option to invest. I will cover all this prospect in detail later in this article.

Do you need LIC insurance policies?

Pros: LIC is a huge organization, along with huge funds. It has been in India since the 50s. In those days, LIC policies were the only method to get life insurance and get profits. LIC used to invest part(a very large part) of our premium into the stock market and then return some part (a small part) of the profits to us at maturity. The LIC repayment and settlement were always prompt. Thousands required LIC policies for the dual benefit – insurance and saving . In fact , the LIC tagline changed to – Beema Bhi, nivesh Bhi (get insurance policy, get savings). LIC returns are tax-free except for pension plan schemes.

Cons: LIC is very poor form on both counts – life insurance in addition to investment. First, life include by LIC 5 lakhs to 30 lakhs is too little. You can of course choose more cover but the superior will be very high. Secondly, the investment return is very poor. At best the return is 6. 5%.

So why can be LIC very popular?

a) LIC promises an assured or guaranteed return and they show an amount that will be paid out for you at maturity (usually between 20 and 30 years). This amount sounds like an awesome AMOUNT at present time.

b) LIC will keep harping you on the undeniable fact that this money is certain. If one brings up market-linked investment, the argument against always is: Sir, market ka kya bharosa? Aaj hai, Kal Nahi? Aapko Vahan koi guarantee data hai kya? (Sir, what is the assurance of the market? Today it is high, tomorrow not so. Can anyone guarantee market profits? )

c) LIC never ever declares the returns in CAGR terms. Hence we remain ignorant.

d) We hear that neighbor, friend, a family member purchased so-and-so LIC policy and we are also instantly concerned – I must have life cover also.

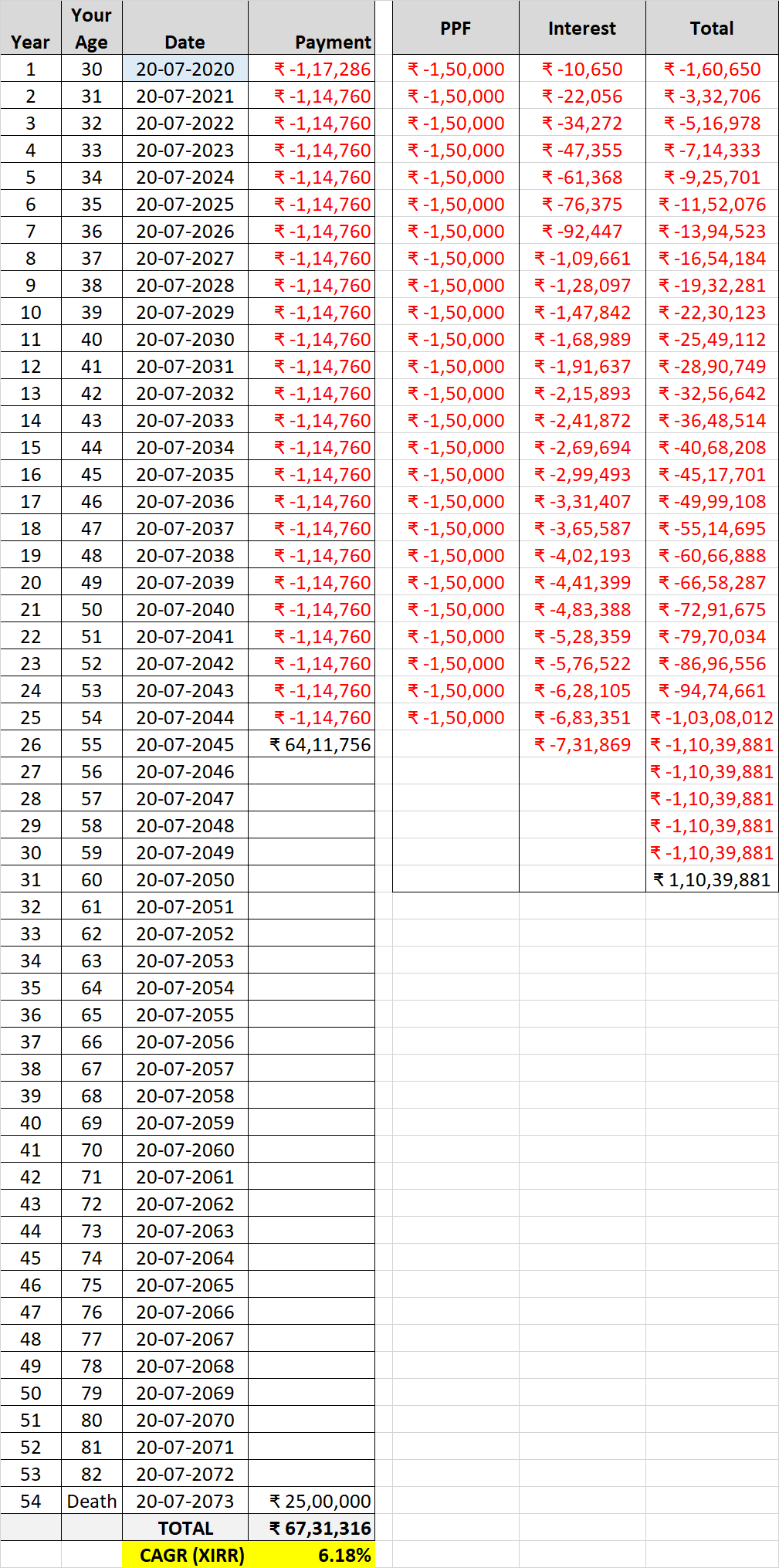

So let us compare the LIC Jeevan Anand 915 policy (the 815 is definitely closed now). The policy sum assured is an instance but the rest of the figures depend on this amount with realistic figures:

[A] Sum confident: ₹25, 00, 000

[B] Term many years: 25

[C] Age at the start: 30

D] Policy begins in a given time: 2020

[E] Premium per ₹1, 00, 000: ₹4, 581

[F] Rebate on the premium (2%): ₹-91. 62

[G] Last Premium per ₹1000: ₹4, 489. 38

[H] Premium per year: ₹1, 12, 234. 50

[I.1] Premium meant for first year @ four. 5% GST: ₹1, 17, 285. 05

[I.2] Premium paid for following 24 years @2. 25% GST: ₹1, 14, 759. 78

[J] Total Premium Paid for full term: ₹28, 71, 519. 68

[K] 125% of total premium: ₹32, 26, 741. 88

[L] Simple Reversionary Bonus price per ₹1000 of SOCIAL FEAR (A): ₹49. 00

[M] Simple Reversionary Bonus Amount for quarter of a century (A/1000 * L): ₹30, 62, 500

[N] Additional Bonus (considered at the same rate for the last year or M): ₹1, 22, five hundred

[O] Final Benefit (Greater of A or K+M+N): ₹64, eleven, 756

[P] Payment upon death after maturity: Sum assured = ₹25, 00, 000

What is the CAGR or return on investment?

- If you consider the full double benefit or O plus P, it is a grand 18% !

- If you don’t consider (P) because of “what is the use of this particular money after my loss of life? ” reason, then it is 72%

- Have you considered the value of ₹64, 11, 756 after quarter of a century, assuming you roll to the policy today? It is ₹14, 52, 263. 67. It really is still not bad but not fantastic as it looked, does it?

Quick review on stock exchange, LIC, and Mutual Finance

Till the mid-eighties, the stock market was just a regular performer. There was very little buoyancy. There were only a few stock deals – just four (BSE, DSE, CSE, and MSE) and some branches. You had in order to trade physically and via a broker. One did not realize markets – even today also very few do understand. After that Harshad Mehta scammed his way to dizzy heights. This caused great interest in the particular stock market as well as scarred folks who lost money. LIC stayed a winner. Mutual Funds were unknown till the past due 90s and only became popular whenever SIP was introduced. In addition, there was no term insurance policy (or LIC never advertised that) and there were no independent private insurance gamers. Hence LIC reigned like a king.

These days LIC tactics are changed. The argument from every LIC employees and realtors is – long-established, always settled (the actual negotiation ratio is 98%), trust over the years, government-backed – will not run away with your money, will not fail, etc . But the biggest argument against Term Insurance policy by these people is – you are paying all this cash but not getting anything in return? Nobody, repeat, nobody provides the real comparison.

So , the alternative?

a) A Term Insurance plan of ₹50 lakhs or more. The premium will be less expensive. See examples at the end.

b) Invest the balance associated with premium in MFs and get much better returns.

Comparison associated with LIC and Mutual fund in Return Prospective

a) To get a LIC premium of ₹9, 572 per month or ₹1, 14, 861 per year, you might be getting a paltry ₹25 lakhs cover. For ₹12, 500 to ₹14, 000, the same 30 years old, a non-smoker person can get a ₹1 Cr cover. For as low as ₹778 pm or ₹9336 pa, you will get twice the cover of LIC or even ₹50 lakhs.

b) One will be quick to jump, what about returns? So here is a comparison with investing in MF SIP

[Q] LIC Payment per month ((J/B)/12): ₹ nine, 572

[R] Term Insurance for 50 Lakhs up to 65 years: ₹ 778

[S] MF SIP per month: ₹ 8, 794

[T] MF Investment term within years (B): 25

[U] SIP Come back: 10%

[V] Corpus at the end of 25 years: ₹ 1, seventeen, 65, 408

[W] Own contribution: ₹ 26, 38, 200

[X] LTCG Tax on MF at 10%: ₹ -9, 03, 863

[Y] Final MF Corpus Value (V+X): ₹ 1, 08, seventy six, 262

[Z] Difference (Y-N): ₹ 44, 64, 506 . (I am not considering Passing away Benefit here because it is not good to me. Even if I did, it is ₹ 19, 64, 506 more and lest one forgets, if the MF corpus will be untouched, assuming 25 years associated with vesting, it will grow to ₹ 12, 76, 34, 190. )

c) You think MF can be risky? Then try PPF . The restriction is ₹ 1 . 5 lakhs per year. But simply by investing for the same 25 years, you’ll ₹1, 10, 39, 881 . But this particular assumes a 7. 1% constant maturity yield and that can change. Still, it is not likely to come down to less than six. 5%. And this amount is tax-free also .

What if you put your cash in PPF

Here is the table:

So there is the same cover for you as LIC but much-much better in respect of more lifetime cover and more return.

Twice the life cover and ₹ 44, 64, 506 more than LIC. What dual benefit? What returns? Is this even comparable? Some will quick to jump that will 10% returns are not possible in MF. I will just say – please move and re-examine. It is quite possible and in fact, I have attained higher results of 12. 75% since Nov-2007. In the last 5 years, I have achieved 22. 13%. 10% is very-very modest and completely probable as long as you do your research, select the right funds, keep monitoring returns plus take remedial actions such as switching. Markets rise and fall but over a long term of 25 years, you will often get a pretty decent come back because of the power of compounding and hedging and averaging due to SIP. I can guarantee this at least based on my own experience.

One particular USP about LIC is it allows loans on the plan. Hogwash! The loan quantity is 90% of the policy give up value at the time of the mortgage, not the particular sum assured. The policy does not allow getting advantages early. If you wanted early benefits, the only way is to surrender the policy completely. With MF, you can dip into the corpus at any time. No need for the loan.

So guys, make sure you believe me when I say :. No endowment or money-back policy is good. Not only it is far from good, but it is also HORRIBLE!!! Do not fall in for fake promises.

Why people buy insurance policies of “guaranteed and assured return”

Unfortunately, people ask this issue after they have already enrolled for the insurance policy. Unfortunately, people discover the phrase “guaranteed plus assured return”. People also look at the assured return quantity and never think that how inflation is going to affect the amount. About to catch alone. I too have got fallen prey to these insurance plans. Eighteen years ago, I signed up for a LIC Jeevan Anand policy with a coverage of 5 lakhs and a high quality of 22, 336. Right after 25 years, I would get 5 lakhs. In 2003, five lakhs was sounded just like a very tidy amount to me. What does it sound like today? Today, I am paying a lot more than this amount in Income tax alone. The CAGR is a paltry 6. 73%! Want many others, who are not financially aware, I realized this pretty late – simply a year ago. Now that the particular policy is maturing in 2028, I now believe that it is better to continue. This is exactly what happens.

Lessons 1: All assured and guaranteed plans have a poor return on investment ranging from 5. 25% to 6. 98%.

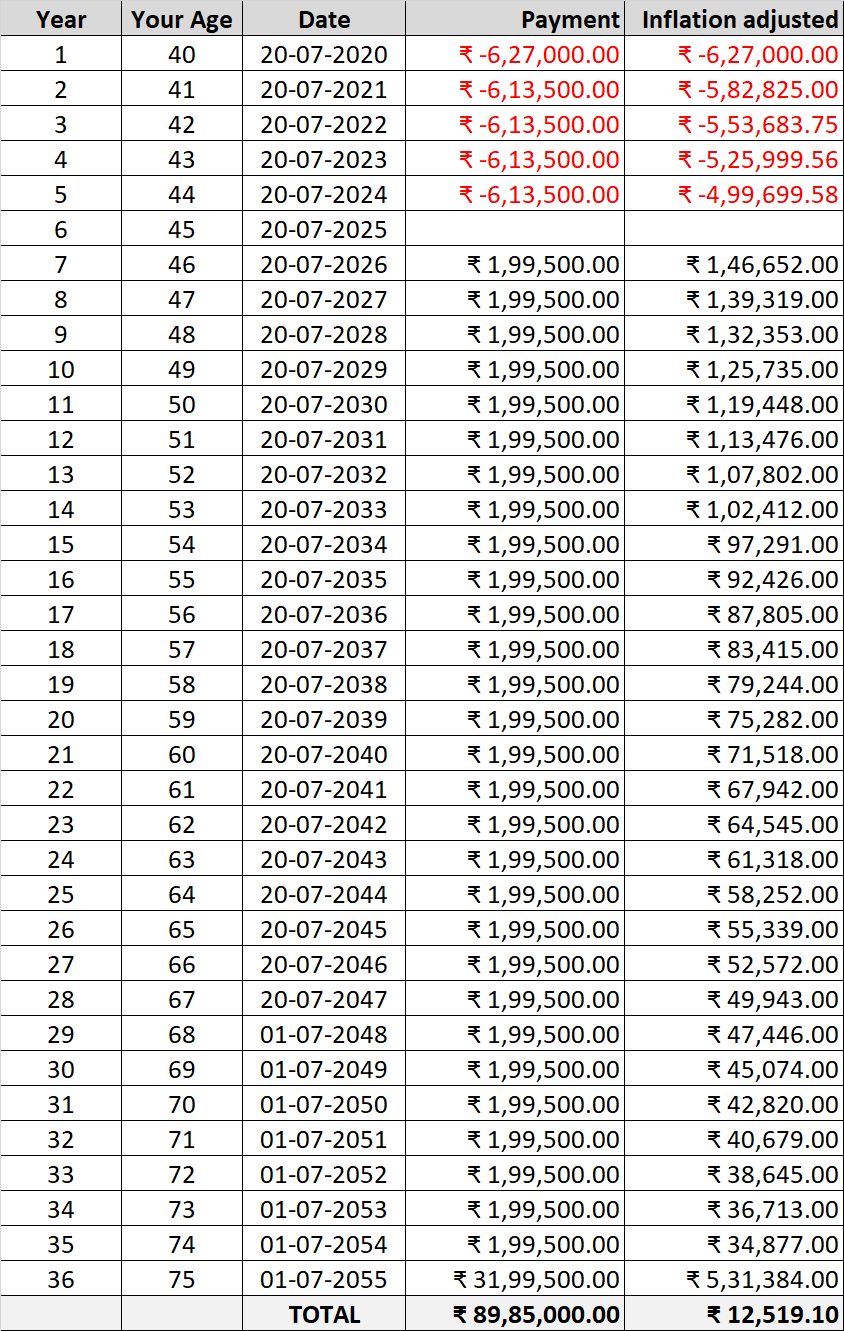

The Jeevan Umang example is already described. Let us look at another illustration. This time I will explain the particular HDFC Standard Life Sanchay Plus scheme. My bank, HDFC, tried hard to market me this policy a while ago. Here are the broad highlights of the plan that I was shown (there are many variations):

Policy Name: HDFC Life Sanchay Plus

Policy Expression: 6 years

Premium Paying Term: 5 years

Premium: ₹6, 00, 00 + GST (4. 5% in first year, second . 25% in next 4 years)

Sum guaranteed: ₹62, 10, 000

Guaranteed Pay-out: ₹1, 99, 500

Guaranteed Pay-out period: 30 years

Critical Benefit: ₹31, 99, five hundred

What does this particular jargon mean? This means I am going to pay 6, 27, 500 in the first year, six, 13, 500 in the next four years, 6 years is a cool-off period for me (I do not need to pay, I don’t get anything). From year 7 onwards I get 1, 99, 500 as guaranteed earnings per year for the next 29 years. In year 37, I get 31, 99, 500. If I happen to pass away anytime during the time the policy is the force (next 30 years), my survivor will get 62, 10, 000.

Does this insurance plan sound beautiful? I am sure that at the first reading it will:

- सिर्फ पाँच साल प्रीमियम भरना है (I have to pay a premium for 5 years only)

- 7 वे साल से अगले 29 साल, हर साल लगभग रु two लाख मिलेंगे (From calendar year 7, I will get nearly ₹2 lakhs per year to get next 29 years)

- 37 वे साल लगभग रु 32 लाख मिलेंगे (In year thirty seven, I will get nearly ₹32 lakhs)

- बीमे की रकम है; कोई टैक्स नहीं लगेगा (All payouts are tax-free as this is insurance payout)

It is only if one does digs heavy, performs the calculation from the return, then one can find out the actual truth. Assume that you are forty when you sign up. This is the chart:

Please evaluate real values vs . inflation-adjusted values. I have considered a 5% constant inflation for all the years. Does this bring out the stark-naked truth? Listed here are the astonishing facts!

- What do you think is the CAGR or real return (4th column)? Return is really a paltry 5. 29%!

- Right now hold your horses, calm down, relax completely, and prepared to be knocked off. What is the inflation-adjusted return? Inflation-adjusted return can be 0. 20%!!!

- You paid an inflation-adjusted ₹27, 89, 207. 90 as high quality and you received inflation-adjusted ₹ 28, 01, 727. The net payment you get is ₹ 12, 519. 10.

- This means that there is no extra return at all. You are hardly getting your money back.

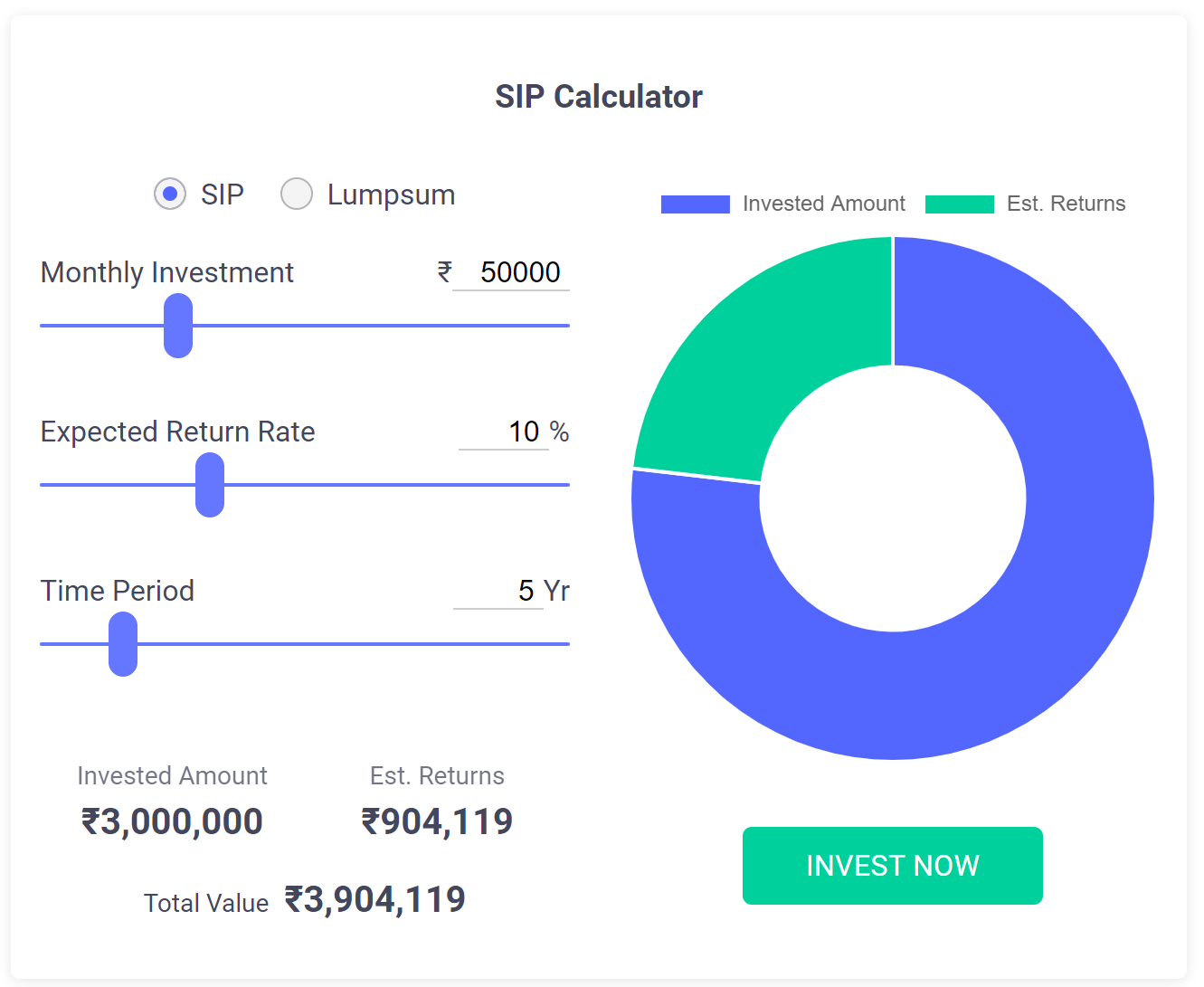

Now imagine, which you saved ₹50, 000 each month for 5 years within a Mutual Money SIP . Then allow the same money invest in the Mutual Fund for the next 31 years. I am going to presume a very-very conservative come back of 10%. This is what it can be.

After 5 years, your SIP corpus will be ₹39, 04, 119 as shown below:

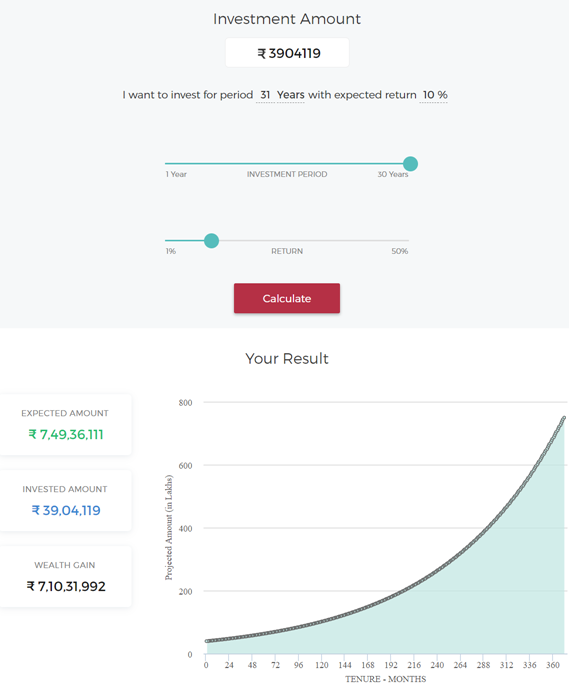

Now let it remain in the same Fund for the following 31 years. No more investment decision. In the end, at the same 10% regular return, you will have a corpus associated with ₹7, 49, 36, 111.

Even if you pay a flat 10% LTCG on this it will ₹7, 49, 3 or more, 611 and your balance available is ₹6, 74, 42, 500. If we adjust this post-tax sum (₹6, 74, 42, 500) for inflation at same 5%, it really is ₹1, 12, 01, 079 at today’s value.

I wonder what you would like now? Friends, I would go for ₹1. 12+ Cr than some ₹28 lakhs.

Couple of things to know about LIC:

- GOI has nothing to do with this (LIC policies). LIC is an indie company having its own legal status, chairman, MD, board of directors, etc . Federal government happens to be the majority shareholder. The GOI does not tell LIC which policies to issue and what should be the T& M, returns, etc . LIC does that. GOI interferes with a few other things regarding employment warranty, reservations, promotion policy, and so forth

- LIC policies are not fake. They offer what they say they will offer. There is indeed a guaranteed return. It is just that the returns are low.

- Agents tend not to tell you the whole truth . It is the LIC providers who are at fault. Perhaps also, they are under a misapprehension. But the truth is that the agent tells you plus sells you a dream. We are duped by the dream. However , the dupe is not to understand the effect of inflation. So we are equally at fault for purchasing something on a promise but not understanding the product correctly.