Free and Easy Approval for Your Big Lots Credit Card

The Big Lots Credit Card

Big Lots, Inc. is an American retail store based in Columbus, Ohio, and today has more than 1,400 stores across 47 states. They offer affordable household items such as furniture, food, and home decor. The Big Lots credit card gets you access to deals and vouchers that only credit cardholders are entitled to.

Big Lots Credit Card’s Requirements to qualify

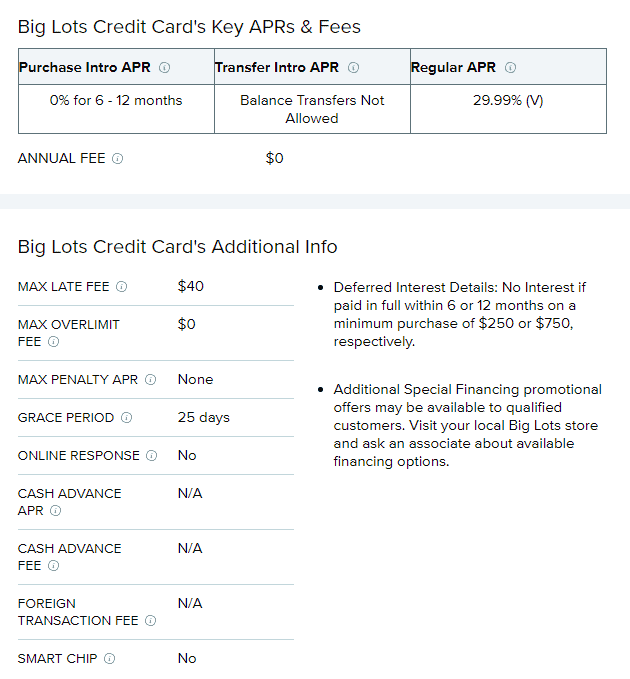

To qualify for this credit card with an APR of almost 30 percent you definitely need to consider having a good credit rating. The Big Lots Credit Card credit limit and APR will be determined based on your creditworthiness. You’ll be notified of your credit limit and other account details after approval.

For the this Card, at least a 638 credit score is needed. The issuer will also take other important factors into consideration, such as your:

- Income

- Existing debts

- Credit history

- Overall creditworthiness

There is no way to pre-qualify for the this Card. An application will likely result in a hard pull on your credit, lowering your score for a short period of time. So make sure you have a good credit score. If you don’t have, increase your credit score before applying.

Advantages You Can Have With Big Lots Credit Card

Big Lots credit Card holders never need to pay the interest in full within six to 12 months. No interest is required to pay only when the purchase amounts to either $250 and more for six months or $750 and more for a year.

As a Big Lots credit card user, you should understand the concept of deferred interest and the payment required scheme. As per the scheme, the company will charge interests from the date of purchase when the client is not able to pay the promo plan balance after the card’s promotional period.

Remember, for each of the credit plans minimum credit card payments are required. There are no guaranteed minimum payments for the promo plan balance in the promo period for the card users. In some circumstances, it may be required to pay more than the minimum payment to avoid incurring charges from the interest.

If a single transaction produces various shipments, then each of these may result in separate credit card plans, depending on different minimum purchase eligibility and minimum interest rate charges.

Benefits of using Credit Card

- no annual fees

- special membership offers

- special financing choices when making qualified purchases

- all-access to the in-store account lookup

- access to the credit card’s account summary details available right at registration

- 24/7 online platform for managing the account

- paperless options for billing

and much more that makes life easier.

Reviews on Big Lots credit card

No rewards. You’ll not get a whole lot of anything from the Big Lots Credit Card, rewards-wise. It’s a big disappointment, as compared to the best store credit cards offer 5% cashback on all purchases, in addition to a hefty first-purchase discount.

Extremely high regular APR. According to WalletHub’s latest Credit Card Landscape Report, the regular APR of this Card’s is higher than the market-average penalty rate: 25.46%.

No annual fee. Generally, store credit cards don’t charge an annual fee. Big Lots Card’s also don’t have an annual fee that will save you about $21 per year compared to the average credit card, this feature is to be expected.

Fair credit required. For most of the store cards, you need at least fair credit to qualify. But for the Big Lots Credit Card, you should only consider if you have fair credit. And even then, it’s not the best choice.

Someone will get a better 0% card with good or excellent credit easily. People with fair credit generally do not qualify for 0% of cards that don’t have deferred interest, But they can still get cards with much lower regular rates.

Mostly asked question (F.A.Q)

How much is the starting Big Lots Credit Card credit limit?

Normally fair-credit applicants start with a limit between $300 and $750, but then they see an increase after regular payments.

How can I pay my Big Lots Credit Card?

You can make a Card payment online, by calling (888) 566-4353. However, the easiest way to pay your Big Lots Credit Card bill is online.

What credit bureau does the Big Lots Credit Card use for approval?

This Card can use any of the three major credit bureaus (TransUnion, Experian, or Equifax) for approval. once your account is open, your financial activity will be reported to all three major bureaus, on a monthly basis.

Can I pay my Big Lots credit card in-store?

No, unfortunately, currently it’s not possible.

How can I add an authorized buyer to the card?

To add an authorized buyer you can call the Big Lots Credit Card Customer Care Center at 888-566-4353 (TDD/TTY: 888-819-1918) or visit comenity.net/biglots.

What is the minimum payment required?

You can find it in the Big Lots credit card agreement and on your billing statement.