seven Important Factors that affect credit score

Impacts of Bad Credit rating

In school, you were usually told about things taking place in your permanent record. The only real permanent record you have being an adult is your credit score. Nevertheless , your credit score does follow a person around everywhere you go.

It decides whether you can get a loan to buy a car or house. It has effects on your interest rates and insurance premiums. A bad credit score forces you to spend expensive deposits for lease, utilities, and mobile phone program. It can even affect regardless of whether you get a job or an advertising.

Bad credit is like a black fog up hanging over you anywhere you go. It’s overwhelming and floods many people with uncertainty. However, you don’t need to passively accept bad credit. Stop holding yourself back with problem and doubts. Debt could be conquered.

It’s possible to buy the car or house of your dreams. Taking control of your financial situation is a breeze when your know-how.

How to get a free annual credit report

Your credit score affects your life in many ways. So the only way to improve credit and guard yourself and your money is to try to stay on top associated with Big Brother. All three firms are necessary by federal law to provide you with a free annual credit report at your request as soon as every 12 months. You also have sixty days to report a free copy if you’re denied credit, insurance coverage, or employment based on poor credit. To order, visit annualcreditreport. com or call 1-877-322-8228.

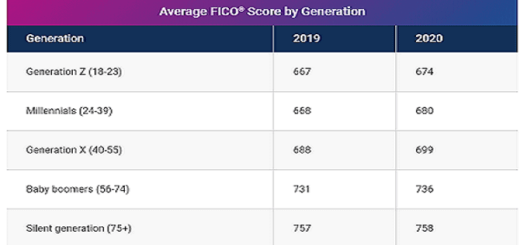

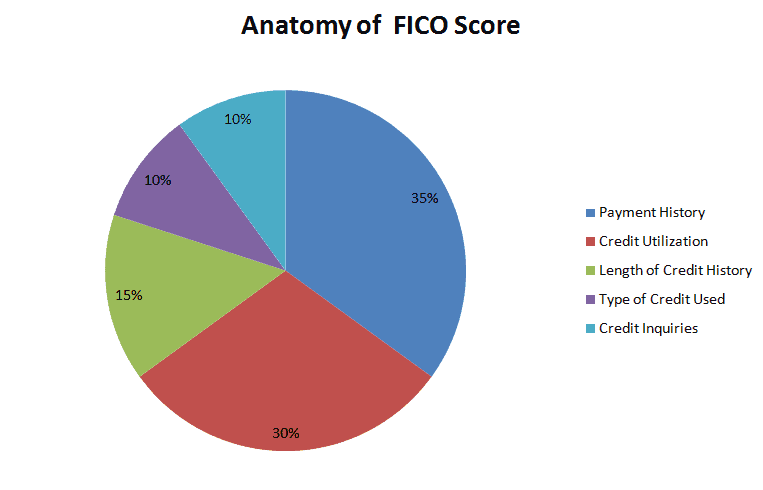

Anatomy of CREDIT Score

Sometimes you will be inside wonder that why is my credit score going down after a particular time? Why would my credit score drop?

First, what are the components of your FICO score anyway? Your credit rating is generally comprised of the following five components.

- 35% Payment History

- 30% Credit Utilization

- 15% Length of Credit History

- 10% Credit score Inquires

- 10% Type of Credit Used

Why does credit score differ across credit bureaus?

To make the lending decision quick and properly greater than 90% of business uses the FICO system to know the financial health of the customer. The biggest three credit scoring companies in the United States Market are usually Experian, TransUnion, and Equifax.

Each credit reporting company place their own standard and business structure because of this each of them makes their very own changes to formulas according to their own rules. This change causes your credit score may very little bit for different reporting companies. However , there are various ways to enhance credit scores.

Seven Factors that affect credit score

Payment history (35%)

This means the bulk of to your credit rating is made up of on-time payments and how much available credit you might have. If you pay all your fees, credit accounts, loans promptly each month then you are in an excellent position. How you handle your debt and how well you pay them is the most important factor that impacts your credit score.

If you miss any kind of payment then a single late payment could have a significant impact on your credit score if you hold a better credit score. According to the FICO information, a 30-day late payment could hurt you just as much as a 90 to 110 points drop in your FICO credit score. Provided that you are a preliminary score of more than 780 and you never missed a transaction on a credit card.

Financial debt Burden (30%)

A lot of experts will tell you to stick to 30 percent of your available credit score. I recommend keeping your obtainable credit at 94 %. You should only be spending $6 for every $100 of accessible credit you have. In short debt burden is the other most important factor that affects your credit score.

If you want to successfully raise your credit to the best possible score. Thus in practice, your credit limit will be five to six periods high than your usages limit to game the machine. This lowers your credit score risk and makes you somebody lenders love to work with.

Length of your credit history (15%)

The length of your credit history contributes 15 percent of your FICO rating. This is relatively less weighted factor in all other factors that will affect credit score.

Usually it takes six months of transaction history to establish a credit rating. In general, the longer the history, the more effect on the rating.

So , in a nutshell, among all the factors that affect credit score, the largest component of your rating, Payment History, looks at skipped or late payments. Credit score utilization subtracts the amount due from your credit limit. Length of Credit History looks basically at the Average Age of Accounts (AAoA) and how long it’s been simply because they were used.

Credit score Inquires or “Hard inquires” happen when you authorize a creditor to check your rating. Finally, by Type of Credit Used they mean Credit Mix. They like to see a variety of different types of credit accounts types, e. g., spinning, installment, open.

Hard inquires may affect your Score (10%)

Hard Inquires will be the less weighted factor in other factors that affect credit score.

Applying for new credit may have an effect on your credit score yet depends on each person’s credit history. In general, there is very less effect on your FICO score. One additional credit query (hard) may result in 5 negative points in your score.

Type of Credit Utilized (10%)

One of the most normal factors used to calculate your credit scores is Credit combine or the diversity of your credit accounts. Maintaining different types of credit score accounts, such as a mortgage, personal loan, and credit card show lenders that you are a potential customer who are able to manage different types of debt effectively. It also helps them get clearer information about your financial healthiness and the potential to pay back debt.

Defaulting on accounts can affect your credit

Various types of negative details like foreclosure, bankruptcy, repossession, charge-offs, settled accounts can show up on your credit report. Each of these harmful items can severely harm your credit for years, even up to a decade.

Can Service Accounts Effect My Credit Score?

Service account like an utility bill, phone bill obligations don’t have any direct effects on the credit score but if you miss any payment and the account was referred to a series agency then it could affect your credit score.

But there is good news that a new product called Experian boost allows customers to get instant credit meant for on-time payments on electricity and telecom accounts.

There are few more factors that affect credit rating. These are the less important factors but are still quite important.

- The way the credit reporting agencies collect and keep your credit information

- What information really does CRA collect

- How is your fico score calculated

The three Credit Reporting Agencies

There are actually only three agencies that you should concern yourself with when talking about your credit score. Feel free to skip ahead if you already know this.

To make the lending decision quick and properly more than 90% of business uses the particular FICO system to know the particular financial health of their customer. The biggest three credit reporting companies in the United States Market are Experian, TransUnion, and Equifax.

Each credit reporting company set their very own standard and business model for this reason each of them makes their own modifications to formulas according to their own rules. This change causes your credit score may very little bit for different reporting companies. However , there are a lot of things and economic habits that matter for your credit score.

What information does CRA collect and maintain?

We may not inform you the exact details of how the CREDIT credit score is calculated but FICO gives us details about what kind of information matters upon its scoring algorithm.

Equifax, Experian, and TransUnion are the big three statement agencies who keep track of your own financial transaction and other info, including:

• Credit card balances

• History of amounts of loan and bank cards

• History of payments on loan and credit cards

• Number and type of accounts you hold

• Personal bankruptcy filings

All these agencies generally collect and maintain your credit score information and then resell this to other businesses. The Experian credit score is a FICO 8 score which ranges between 300 and 850TransUnion score also ranges from 300 to 850. Like the others, Equifax also provides FICO and Vantage Score and uses different scoring models which range between 300 and 850.

How is your fico score calculated?

Your credit score is based on a secret algorithm designed by FICO, originally Fair, Isaac, and Company. The details of this algorithm remain hidden under a veil of secrecy even today. Though we do know the formula is generally comprised of the following five components or factors.

• Most Important factors – 35% Payment History

• Very Important facets – 30% Credit Utilization

• Somewhat important – 15% Length of Credit History

• Somewhat important – 10% Credit Inquiries

• Less Important factors – 10% Type of Credit Used

Now let’s talk about small things to do that can potentially make a big impact on your score to alter your life!

No Credit Check Loans and Cryptocurrency – opportunity to start

Read more

Piggyback hack to Boost Score – Sometimes 100+ Points

Read more