638 Credit Score: Your Eligibility for Best Loan, Mortgages and Lease

What is a good credit score ?

Credit scores are used by lenders to calculate the risk of financing money. It’s a tool to help creditors determine how likely you might be to repay their loan. The majority of the major credit agencies in the United States use the FICO score to evaluate your own credit health.

Your CREDIT score normally ranges between 300 and 850. So , What’s a good credit score? Is 638 Credit Score really poor? While each creditor may have their own calculation, generally the subsequent breakdown applies.

- A FICO score below 630 is considered as Bad Credits

- An average or Fair score is among 630 and 690

- Good Score is between 690 and 720

- An excellent score is anything above 720

so , in a nutshell, you have poor credit and you are eligible for the most severe interest rates on home loans, auto loans, credit. Why did my credit score drop

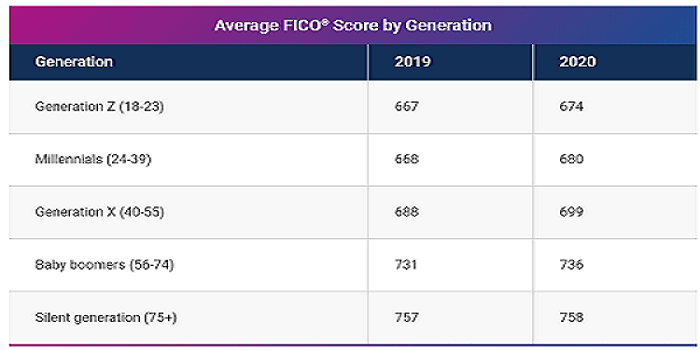

Average credit score by age group in 2021

Source: Experian

Is 638 credit score good or bad?

Your FICO credit score , created by the Fair Isaac Corporation, is used by lenders, creditors, landlords, and even companies to assess your credit risk.

The criteria for a good credit depends upon what you’re applying for . Although a 638 credit score isn’t necessarily poor credit, this won’t be enough for an expensive condo rental or mortgage. It also depends on where you live.

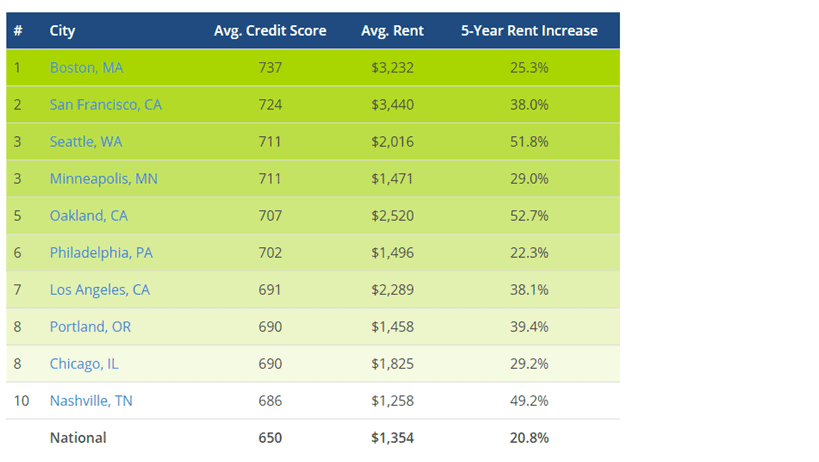

In cities like Boston, MOTHER; San Francisco, CA; Seattle, CALIFORNIA; Minneapolis, MN; and Philadelphia, PA, the average credit score of tenants is over 700 . But in cities like Greenwood, MS; Albany, GA; Laredo, TX; or Riverside, CA, the average credit score is below 650.

List of city-wise best average credit scores for lease in the country

Your credit score is one of the most important factors landlords use whenever deciding whether to rent to tenants. Here’s a chart showing the cities with the greatest credit scores in the country , which means you know what you’re competing towards.

City-wise Avg. Credit score for Rent

638 Credit Score: Opportunity for Car Loans

Experian recently released a study showing credit scores for new and used car buyers. The average recipient of the new-car loan has a 713 credit score , while the used-car loan average was 656.

Around 20 percent of borrowers got a car loan with credit ratings below 650 and 5% had credit scores below five hundred. While people with these lower credit scores were able to secure an auto loan, they paid a lot more for it. So it’s very important to understand your credit score before applying for any kind of loan or mortgage.

Borrowers with great credit typically pay less selling price for the down payment

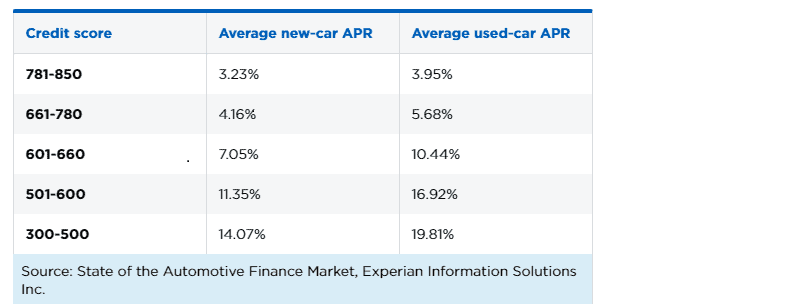

Borrowers with great credit typically only must pay $1000 or 10 percent of the selling price for a deposit. With bad credit, this doubles to 20 % or more, and that’s not all. Here’s a breakdown of how credit scores affect the interest rates for a number of.

interest rates for car loans

As you can see, a credit score of 700 will get you an annual percentage rate (APR) of 4. 16-5. 68 percent. Meanwhile, a 638 credit score nearly triples that APR. I bet a person didn’t realize your credit score was costing you so much. The above statistics show that it is not really 638 Credit Score is good yet all you need is a little bit of boost to your credit score.

Let’s state you get an auto loan for $10, 000 for five years . With a 4. 16 % APR, you’ll pay an overall total of $11, 204. 22, assuming you’re never late with a payment. At sixteen. 92 percent, you pay $15, 034. 61 by the end of your loan. Even with a greater down payment, you’ll end up with increased monthly payments and pay nearly 40 percent more right at the end of your loan.

A detailed comparison of how much more an auto loan will cost to get someone having a 570 credit score versus a credit score of 650.

Let’s take a close look:

| Loan Type | Credit Score | Rate | Payment | Added Cost |

| 36-month new auto | 650 | 9. 31% | $862 | $0 |

| 570 | 14. 80% | $933 | $2, 550 | |

| 48-month brand new auto | 650 | 9. 33% | $676 | $0 |

| 570 | 14. 81% | $749 | $3, 491 | |

| 60-month brand new auto | 650 | 9. 40% | $566 | $0 |

| 570 | 14. 822% | $640 | $4, 443 |

638 Credit Score: the opportunity for a Mortgage

Mortgages have even higher credit score requirements! You need a credit score of at least 740 to qualify for the very best loans with the lowest down payment requirements ( 20 percent ) plus interest rates. Many lenders will certainly qualify you for a regular mortgage at 700, and several will even finance you as low as 620, although this is easier with VETERANS ADMINISTRATION – or USDA-backed loans .

Once your credit score drops beneath 638, your best bet for a mortgage is the Federal Housing Administration (FHA), but you’ll require a down payment of 10 percent . That’s much better than the 20 percent or more needed on a conventional mortgage. Although with an FHA loan, you’ll need more PMI.

FHA Mortgage with 638 Credit Score

With a 638 credit score, you can qualify for FHA loans. Other FHA loan specifications are which you have at least 2 years of work, which you will be required to offer 2 years of tax returns, as well as your 2 most recent pay stubs. The maximum debt-to-income percentage is 43% (unless you have satisfactory “compensating factors”, like a higher down payment, or money reserves).

The reason behind the popularity of FHA loans would be that the down payment requirement is only a few. 5%, and it can be borrowed, gifted, or provided via down payment assistance program.

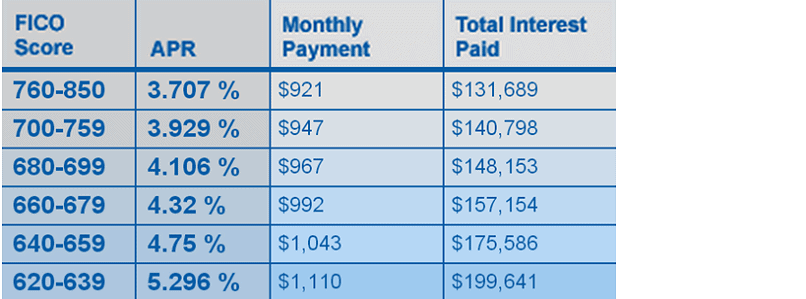

How much mortgage interest rates differ with credit score

638 Credit score also affects mortgage interest rates. A FICO score of 700 will get you a four. 49 percent APR , whereas a 620 rating comes with a 5. 857 percent APR. Over the course of a 30-year mortgage, that’s a difference of $60, 000 on an one hundred dollar, 000 home. Of course , mortgage rates are always changing. As of August 2021, the average INTEREST is 4. 57 %.

Here’s a chart showing the difference your credit score makes.

in case you improve your credit rating from poor to good, you would conserve

- $ 189 monthly

- $ 2268 per year

Let us assume that you may qualify for a good FHA loan with a credit rating of 638. Now check the charts below:

| Credit | Score | Rate | Payment | Added Cost |

| Excellent | 720-850 | 4. 31% | $1, 487 | $0 |

| 700-719 | 4. 53% | $1, 526 | $14, 040 | |

| Moderate | 675-699 | 4. 71% | $1, 558 | $25, 560 |

| 620-674 | 4. 93% | $1, 597 | $39, 600 | |

| Poor | 570 Credit rating | 5. 36% | $1, 676 | $68, 040 |

So not only will a bad credit score require higher build up and down payments, it increases monthly payments and complete loan repayment amounts. That is why it’s important to maintain a good credit score . Bad credit should come back to haunt you whenever you try to buy your dream house or a new car.

638 Credit Score: Credit Cards

Such as other lenders, Credit scores are used by credit card lenders in order to calculate the risk of lending money. It’s a tool to help lenders determine how likely you are to settle their loan. Most of the major credit agencies in the United States use the FICO score to evaluate your credit score health.

Your FICO rating normally ranges between three hundred and 850. While each creditor may have its own calculation or parameter to determine its customer financial health. If you have a good credit score (more than 750) then only you will end up approved for cards for that lowest rates and greatest rewards.

For a poor credit score or if you have a 570 credit score then you will qualify for the guaranteed credit card. To qualify for a credit card, you need a minimum credit rating of 600. It also depends on what type of credit card you are trying to get.

Based on your credit score not only qualifying for a credit card , but your score also has a significant impact on the APR and other conditions of your account. The graphs below show the differences in the interest rate and annual fees between someone with a good credit rating and a credit score of 570.

| Card Kind | Score | Rate | Stability | Added Cost |

| Platinum | 720-850 | 4% | $5, 000 | $0 |

| 700-719 | 6% | $5, 1000 | $362 | |

| Gold | 675-699 | 8% | $5, 000 | $774 |

| 620-674 | 10% | $5, 000 | $1, 250 | |

| Standard | 570 Credit Score | 16% | $5, 000 | $3, 240 |

Frequently asked questions

Can I get a jumbo mortgage with a 638 credit score?

To qualify for the jumbo loan the minimal credit score depends on the lender. The majority of jumbo lenders prefer a credit score of at least 720 to provide a jumbo loan. However , you can get a jumbo loan with a credit score of 600 from non-prime lenders. Therefore the chance for getting a jumbo loan having a credit score of 638 can be done.

So what do non-prime loans offer?

Non-prime loans offer an opportunity to get a mortgage with regard to borrowers that do not be eligible for a conventional and FHA loans. They have got much less strict credit needs, including no waiting intervals after bankruptcies, foreclosures, and short sales. Non-prime financial loans also are available to borrowers along with credit scores as low as 500 (or even below 500).

Should I be eligible for a home loan if I have a major credit issue last year?

If you have had a personal bankruptcy, foreclosure, or short purchase, there are several non-prime lenders that provide home loans to borrowers even just 1 day after such events.

What are other credit requirements that I need to know about?

Most mortgage lenders anticipate mainly 3 trade lines on your credit report like auto loans, credit cards, personal loans, or some other qualifying lines of credit. There may be conditions like alternative bills which are often allowed (phone bills, utilities, etc . ).

Is deposit assistance available to someone with a 638 credit score?

Yes, at present the applications exist at the local (city, county, or state level), and nationwide level. A mortgage lender can help you to check if a person qualify for down payment assistance. Regarding lower-income, the chances are more likely to meet the criteria, as these programs are often designed for lower-income households.

What are the interest rates to get a borrower with a 638 credit score?

The interest rate will depend on your individual qualifications, the particular mortgage lender, and the date you lock your interest rate.